Table of Content

Guilford Hills offers a slower-paced ambience and will appeal to home buyers who enjoy spending time in green spaces. This neighborhood is quiet overall, as the streets are quite peaceful. Finally, access to green spaces, like Guilford Hills, is easy from most locations within the neighborhood since there are a few of them close by for residents to relax in. Needs to review the security of your connection before proceeding. If you're looking to sell your home in the Guilford Hills area, our listing agents can help you get the best price.

Guilford Hills is a minimally walkable neighborhood in North Carolina with a Walk Score of 46. In addition to houses in Guilford Hills, there were also 2 condos, 0 townhouses, and 0 multi-family units for sale in Guilford Hills last month. Driving is a very good transportation option in Guilford Hills. On the other hand, getting around by public transit is very hard in Guilford Hills. There are relatively few pedestrians out on the streets of this part of the city, even though running common errands is convenient by walking.

Luxury Homes Around North Hills

One of the most charming, desirable communities in Greensboro is Guilford Hills, located less than 10 minutes from downtown Greensboro. As you walk through these spacious Greensboro homes, you will fall in love with the spacious living rooms boasting fireplaces, vaulted ceilings, and gorgeous hardwood floors that make a wonderful place to entertain. Updated kitchens feature granite countertops, new cabinets with premium hardware, ceramic tile floors, pantries with built-in shelving, stainless steel appliances, and large center islands where guests and family can hang out while you are cooking dinner. Master bedrooms are large enough for a king sized bed with many having extra sitting room space.

Closed listings may have been listed and/or sold by a real estate firm other than the firm featured on this website. Closed data is not available until the sale of the property is recorded in the MLS. Home sale data is not an appraisal, CMA, competitive or comparative market analysis, or home valuation of any property. Guilford Hills offers residents a great location close to Friendly Center shopping mall, the airport, and many other popular places. Hospitals and several universities and colleges are within minutes of Guilford Hills making it a great choice for faculty and staff that want to find their next home close to where they work.

Living in Guilford Hills

Contact a local real estate professional or the school district for current information on schools. This information is not intended for use in determining a person's eligibility to attend a school or to use or benefit from other city, town or local services. A supermarket is ordinarily accessible within a rather short walk from anywhere in Guilford Hills. Moreover, those who like to dine in restaurants will have a good number of options. As far as education is concerned, it is a rather short walk to reach primary schools from most houses for sale in Guilford Hills.

Updates include a newly renovated kitchen with SS appliances, quartz counter tops, and beautiful new tile backsplash; new light fixtures & paint throughout; newly refurbished hardwood floors; newly renovated bathrooms. This wonderful home also features built in shelves, a wood burning fireplace, fenced back yard, back deck and a barn door leading to the oversized mud room off the kitchen/den. The broker providing this data believes it to be correct, but advises interested parties to confirm the data before relying on it in a purchase decision. Personal, non-commercial use and may not be used for any purpose other than to identify perspective properties consumers may be interested in purchasing. Any use of search facilities of data on the site, other than by potential buyers and sellers is prohibited.

What is transportation like in Guilford Hills?

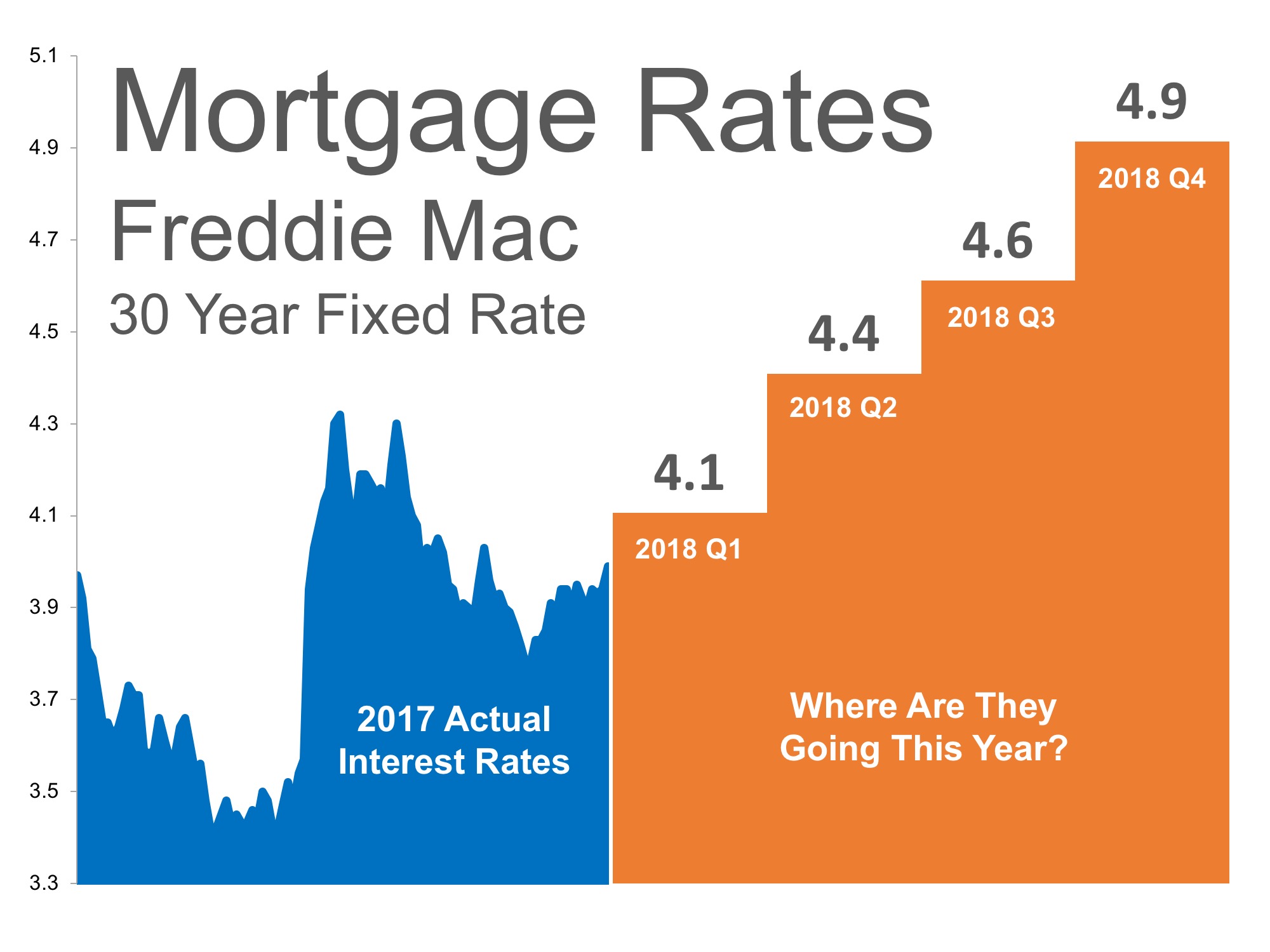

About half of properties in this neighborhood were built in the 1960s and 1970s, while most of the remaining buildings were constructed pre-1960. This part of Greensboro is primarily composed of two bedroom and three bedroom homes. About 80% of the population of this neighborhood own their home whereas renters make up the remainder. CENTURY 21®, the CENTURY 21 Logo and C21® are service marks owned by Century 21 Real Estate LLC. Century 21 Real Estate LLC fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Listing information is deemed reliable but not guaranteed accurate. Use our mortgage calculatorto see how much it would be to finance a home in Guilford Hills.

Homes for sale in Guilford Hills have a median listing price of $220K. Some of these homes are Hot Homes, meaning they're likely to sell quickly. Popular neighborhoods include Hamilton Forest, College Hill, Westerwood, Carriage Hills, and New Irving Park. School service boundaries are intended to be used as reference only. To verify enrollment eligibility for a property, contact the school directly.

Results within 2 miles

This information is not verified for authenticity or accuracy and is not guaranteed and may not reflect all activity in the market. Our top-rated real estate agents in Guilford Hills are local experts and are ready to answer your questions about properties, neighborhoods, schools, and the newest listings for sale in Guilford Hills. Redfin has a local office at 1435 West Morehead Street Suites 135 and 235, Charlotte, NC 28208. Don’t miss the opportunity to make this beautifully renovated home in desirable Fairwood Forest YOURS!

There are plenty of entertainment options within a couple of miles of the area including the Greensboro Children's Museum, Lake Daniel Park, and a variety of restaurants such as The Sage Mule, Burger Warfare, Print Works Bistro, and Hops Burger Bar. Redfin is redefining real estate and the home buying process in Guilford Hills with industry-leading technology, full-service agents, and lower fees that provide a better value for Redfin buyers and sellers. The sizeable percentage of single detached homes in the housing stock of Guilford Hills is an important part of its character.

Copyright© 2022 Triad MLS, Inc. of High Point, NC. All Rights Reserved. Searching for luxury real estate in North Hills, Greensboro, Guilford County, NC has never been more convenient. You’ll find 11 luxury homes for sale in North Hills, Greensboro, Guilford County, NC, with prices ranging from to . This information is provided for general informational purposes only and should not be relied on in making any home-buying decisions.

Elegantly designed Master bathrooms feature dual sinks, walk-in closets, tile showers with built-in seats, and whirlpool tubs. Additional details include upgraded bathrooms, spacious secondary bathrooms, laundry areas, and finished basement space. Backyards are fenced-in and provide plenty of space for hosting weekend cookouts and enjoying family time with the kids and pets. The listing data on this website comes in part from a cooperative data exchange program of the multiple listing service in which this real estate Broker participates.

The detailed listing page about such properties includes the name of the listing Brokers. Information provided is thought to be reliable but is not guaranteed to be accurate, so you are advised to verify facts that are important to you and no warranties, expressed or implied, are provided for the data herein, or for their use or interpretation by the user. The North Carolina Association of Realtors and its cooperating MLSs do not create, control or review the property data displayed herein and take no responsibility for the content of such records. Federal law prohibits discrimination on the basis of race, color, religion, sex, handicap, familial status or national origin in the sale, rental or financing of housing. BEX Realty is an equal housing opportunity real estate broker and along with its individual brokers, Realtors® and real estate agents, specializes in luxury waterfront and golf and country club property in North Carolina.